Overview

The Client:

Experian, a leading global information services company, was the principal client for this project, supporting BBVA Compass (a leading U.S. banking franchise) in creating an online credit card application process for the NBA/American Express Partner Card.

The Problem:

Design a high conversion application process that elevates the branding for a new credit card series launch.

The Solution:

Before engaging with the form:

Clarify the value proposition with informative and motivating content marketing. Use relevant, visually exciting, and branded UI design, with large and high-contrast calls to action for easy conversion. Set user expectations for the time it takes to complete the form and to get approval.

While engaging with the form:

Use as few pages and fields as possible and limit navigation away from the form. Prominently indicate form security. Make required fields very obvious and provide contextual help throughout the page with instant and clear error handling.

My Role

I was brought on board as the lead designer in charge of the custom UI, UX, and visual design.

The Core Team:

This project was orchestrated and executed through a relationship with K Street Partners.

Angela Lester - CEO/CXO

Cynthia Mellow - Managing director

Nick Fico - Insights & Analytics Strategy

Eric Tomlinson - Creative direction, UI/UX, visual design

Analysis and Optimization

An analysis of current analytics, as well as competitive and industry benchmarks reviews, informed the UX approach and application optimizations. This elevated key insights such as limiting fields and navigation, providing contextual user guidance, and the tone of the copywriting.

UI DESIGN AND USER EXPERIENCE FLOW

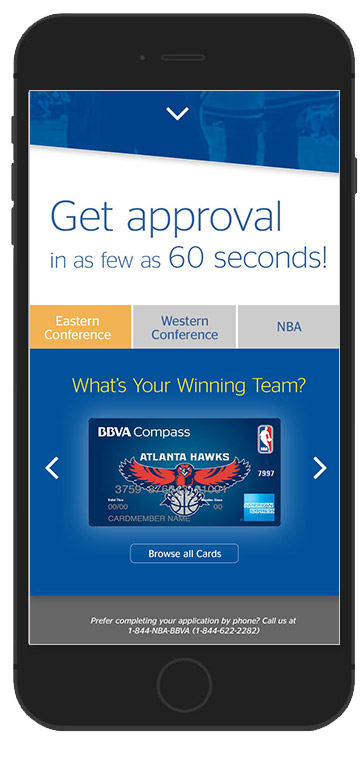

1. The "splash" has a clear call to action and value proposition with emotional and branded imagery.

2. As the user scrolls, the low time obligation to convert is highlighted. This, along with simple navigation elements and a graphic of the end product help build excitement and to reduce friction for getting started.

3. The "browse all cards" option allows the user a larger view of the card options through a vertical scroll.

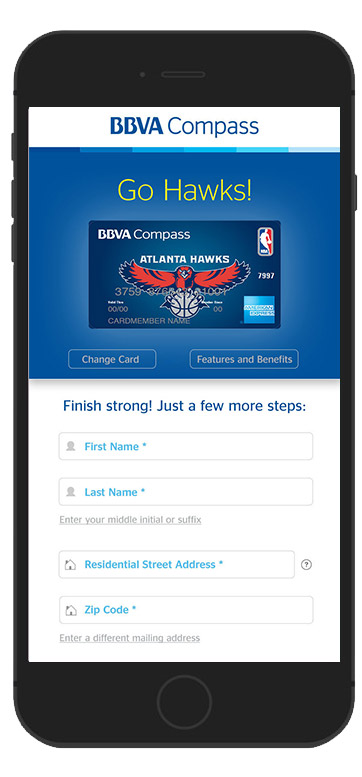

4. Since the user has now chosen their favorite team, the chances of the user completing the application process are greatly increased.

5. Visual cues throughout the process make it instantaneously clear when the user has skipped required information, has provided appropriate information, has options to provide alternative information, or needs special clarification for certain input fields.

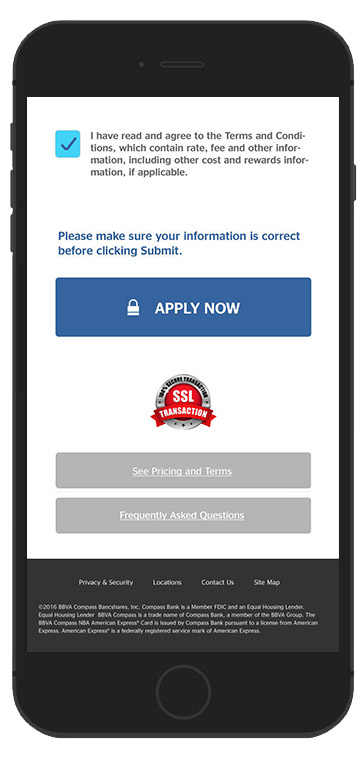

6. Verifications of terms and security aim to remove any final barriers to applying, however, options are provided to clarify any last-second concerns.

7. Features and Benefits, available at several stages in the application process, illustrates the full range of benefits for the potential card holder. Closing this screen allows the user to go back to the Apply Now screen without losing their previously input information.

8. A FAQ page is provided near the end of the application process for those users that still have questions before making a commitment. Closing this screen allows the user to go back to the Apply Now screen without losing their previously input information.

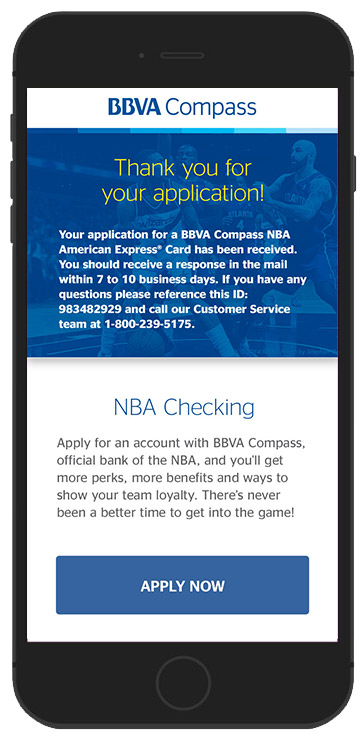

9. Finally, after the user is approved, all the necessary information is served up so that the knows when the card will arrive, who to contact with any questions, and all the details of their new line of credit.

10. However, if for some reason the application is denied or delayed, the user is offered the chance to follow up with a representative or easily apply for a checking account.